rank real estate asset classes by risk

You alone assume the sole responsibility of evaluating the merits and risks associated with the use of this information before making any decisions based on such information. What is an Asset Class.

Asset Class Definition Types Of Asset Classes Franklin Templeton

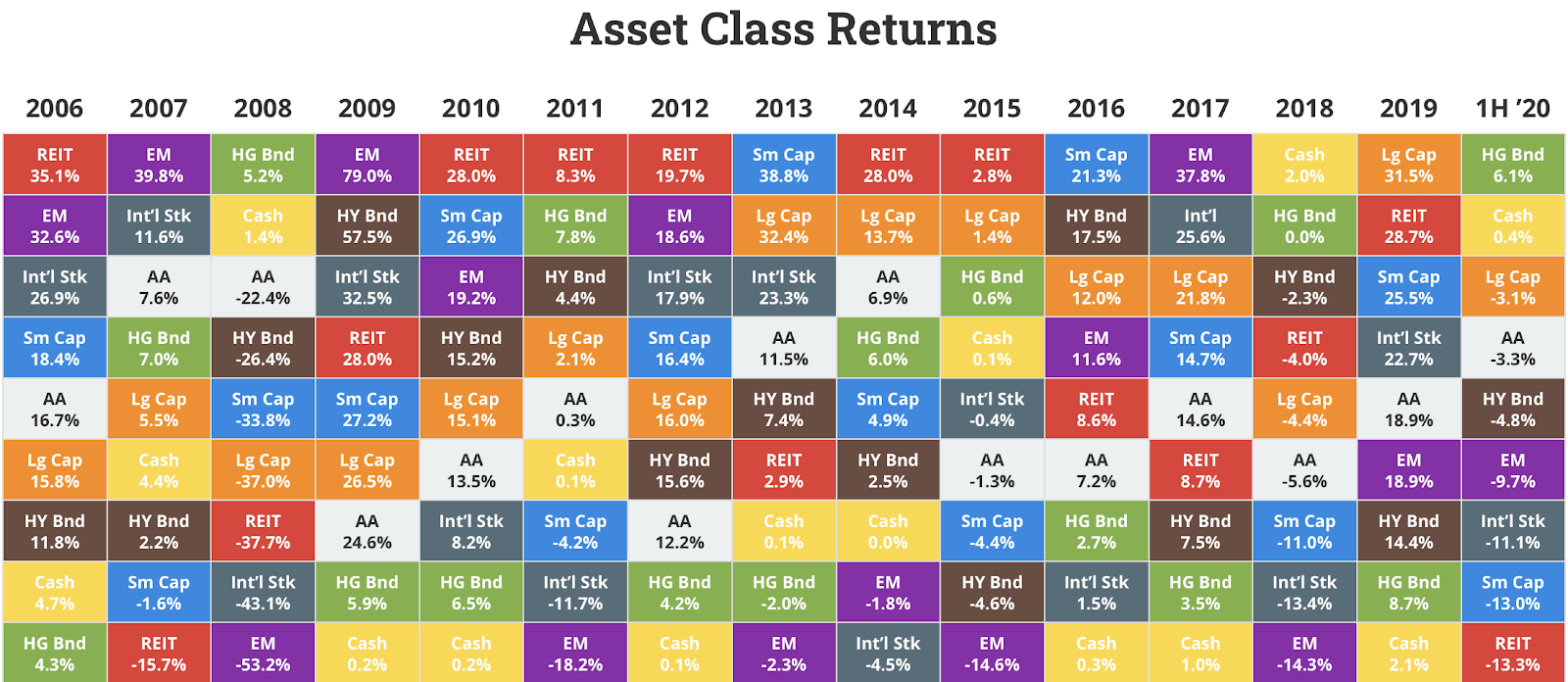

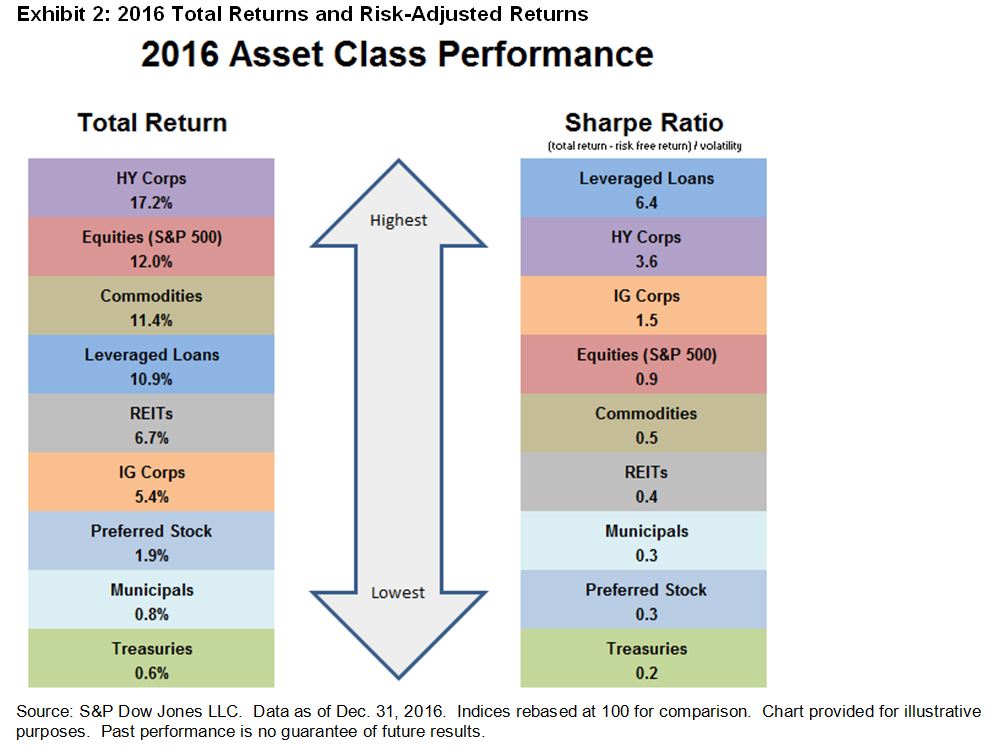

Plummeting oil prices and an equities bull market that left little demand for safe haven assets like precious metals likely contributed to the asset class underperformance.

. Green blue black and diamond. However workforce multifamily has historically been a. Most will rank them on a general scale from Class A to Class C with others going as far as from Class A to Class F.

Dear all Im having trouble to find arguments when ranking real estate asset classes in terms of risk. It uses real total returns meaning that they account for inflation and the reinvestment of dividends. Backed by the US.

2 days ago Mar 17 2019 Dear all Im having trouble to find arguments when ranking real estate asset classes in terms of risk. When investing some assets are considered safe while others are considered risky this includes savings accounts T-bills certificates of deposit equities and derivatives. The top-performing asset class so far in 2020 is gold with a return more than four times that of second-place US.

-Multifamily -Retail -Office -Student living -Light industrialsLogistics -Hotels -Co-working spaces I know that there are several factors playing into this but assuming as much is equal is possible what would be a plausible ranking. The Graph is inspired by and uses data from The Measure of a Plan. Including lower subcategories of each class such as A- B- and C- etc.

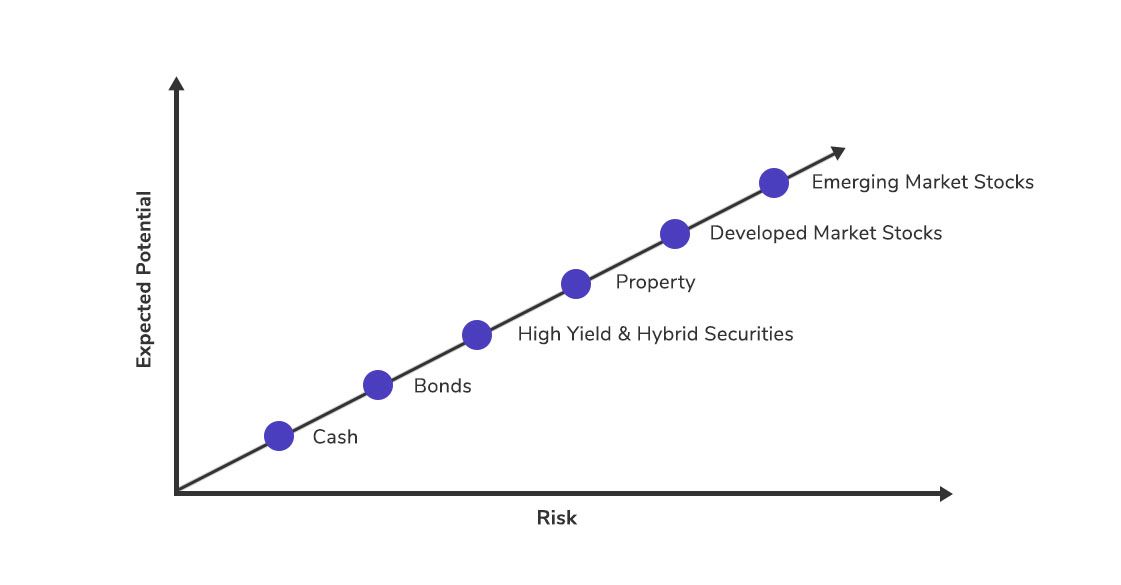

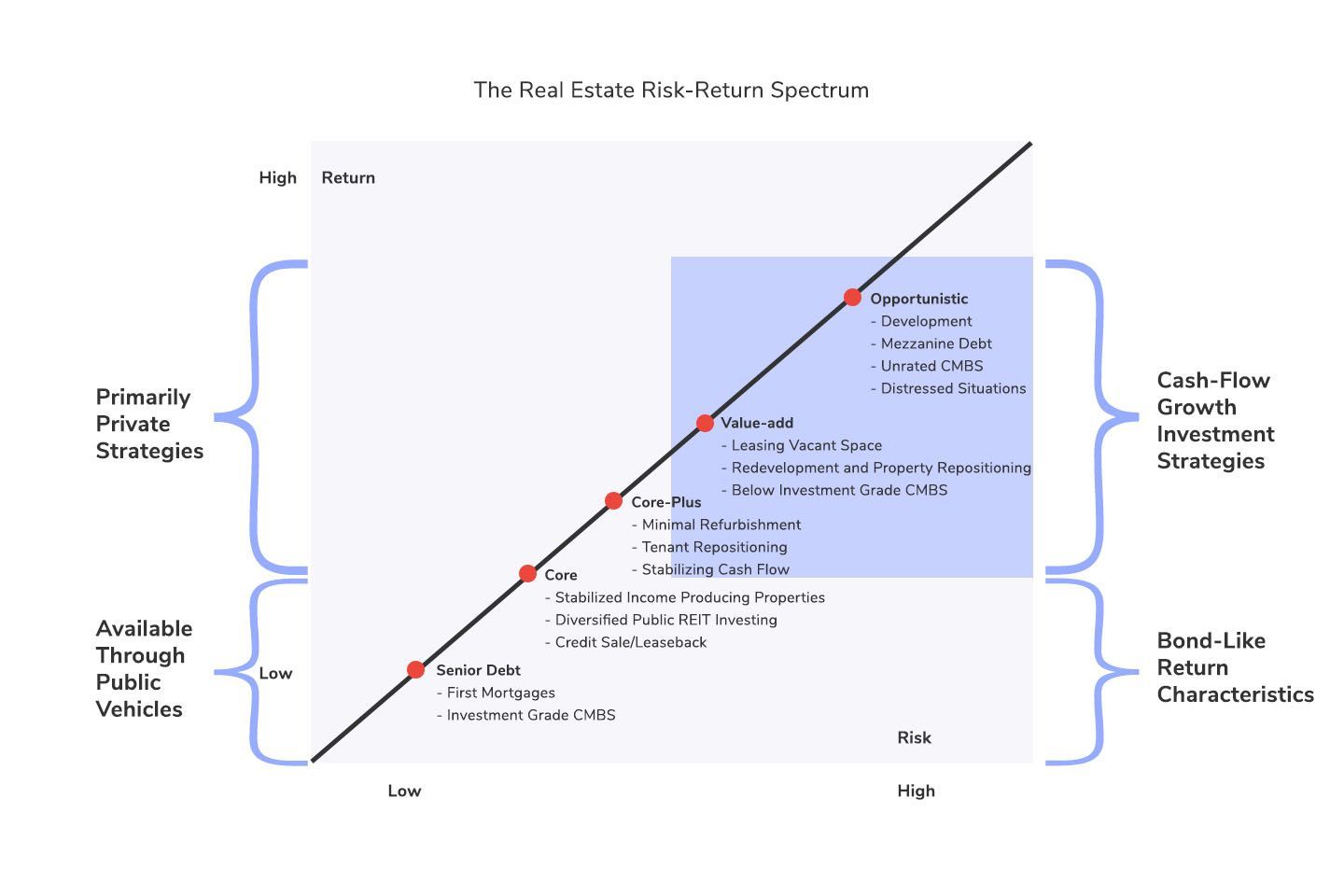

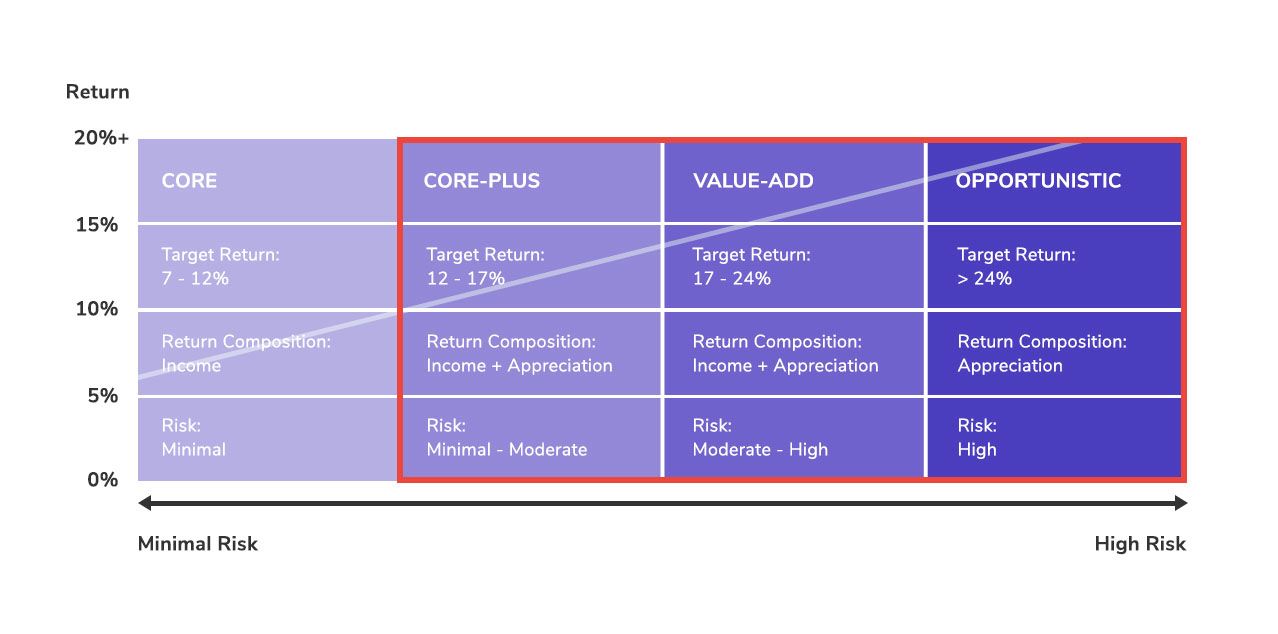

This analysis includes assets of various types geographies and risk levels. We estimate the cost of debt to increase with the leverage ratio and consequently the riskreturn is curvilinear This riskreturn continuum is depicted in the following. Im mainly looking at.

Homes built in the last 30 years. Different classes or types of investment assets such as fixed-income investments. Equities offer an ownership stake in a.

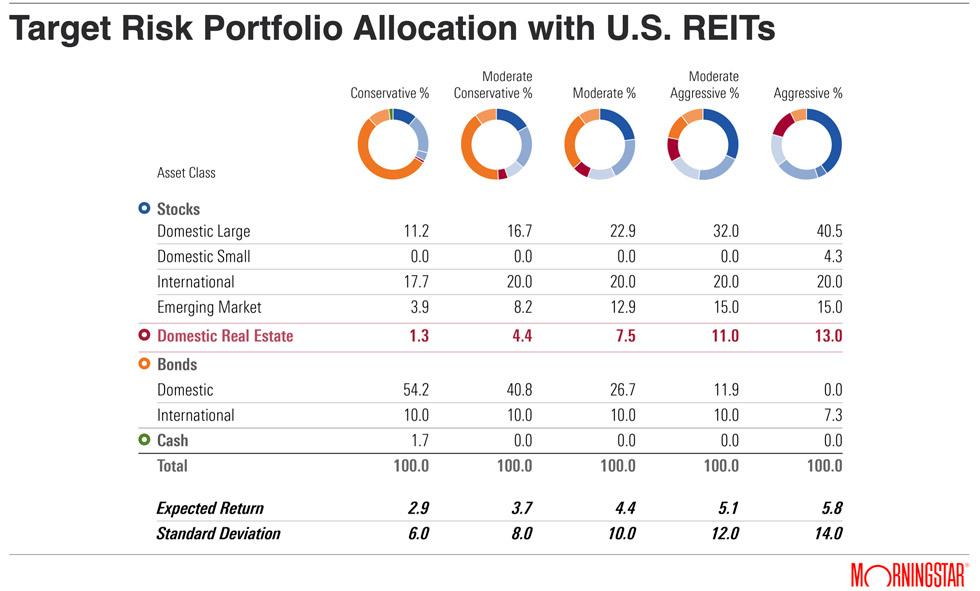

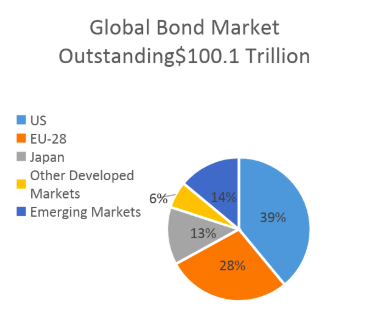

An asset class is a group of similar investment vehicles. 300 Park Avenue 15th Floor New York NY 10022. First the return correlations of commercial real estate compared to other asset classes has historically been low.

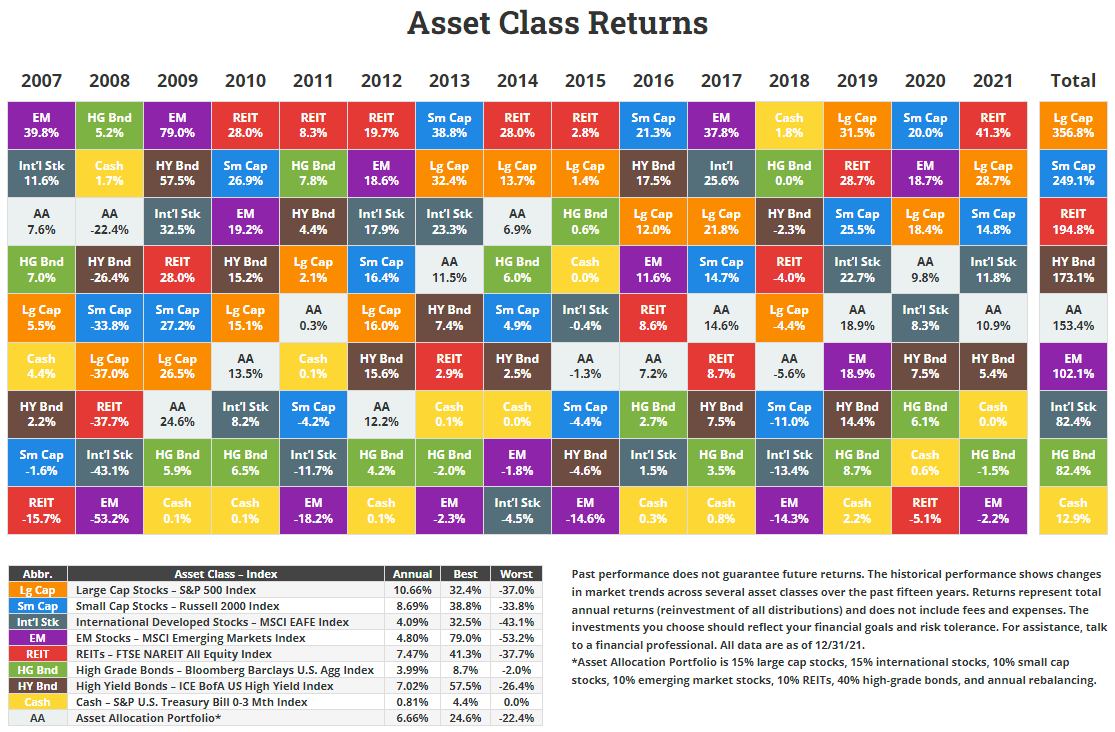

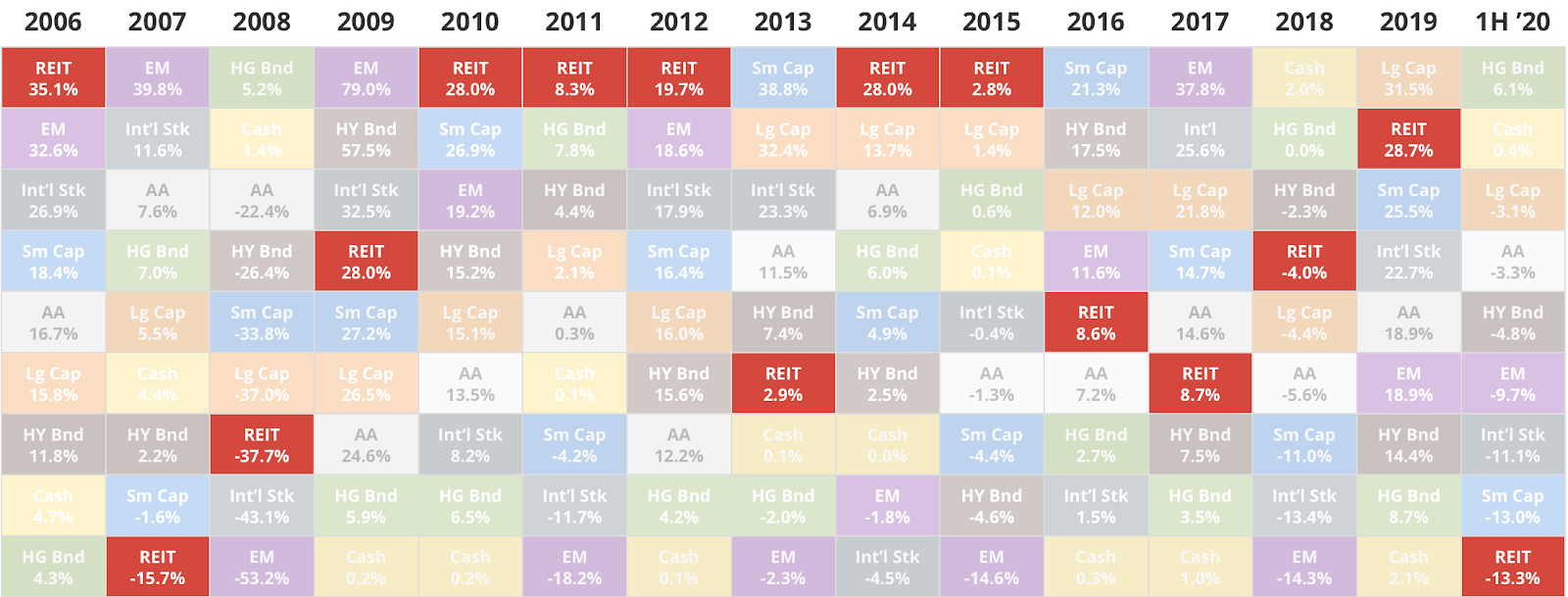

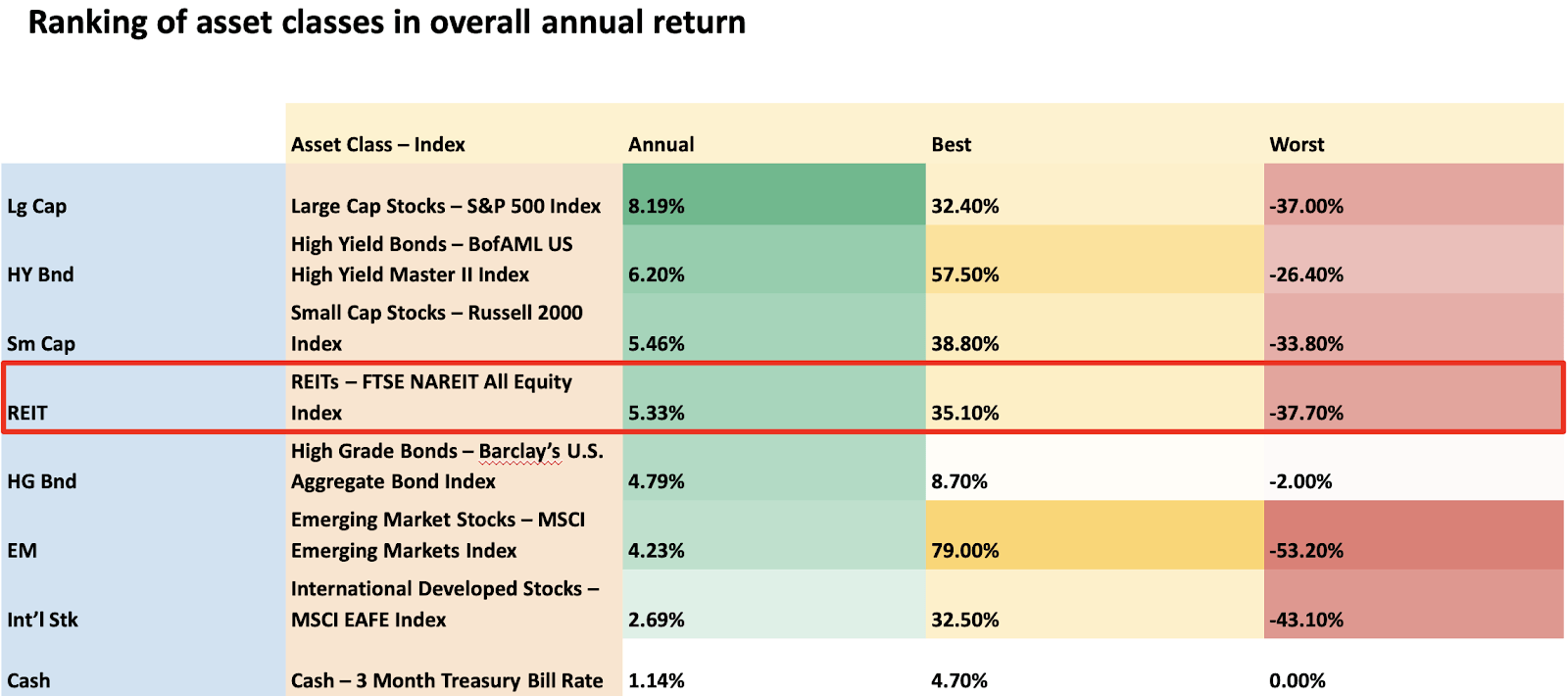

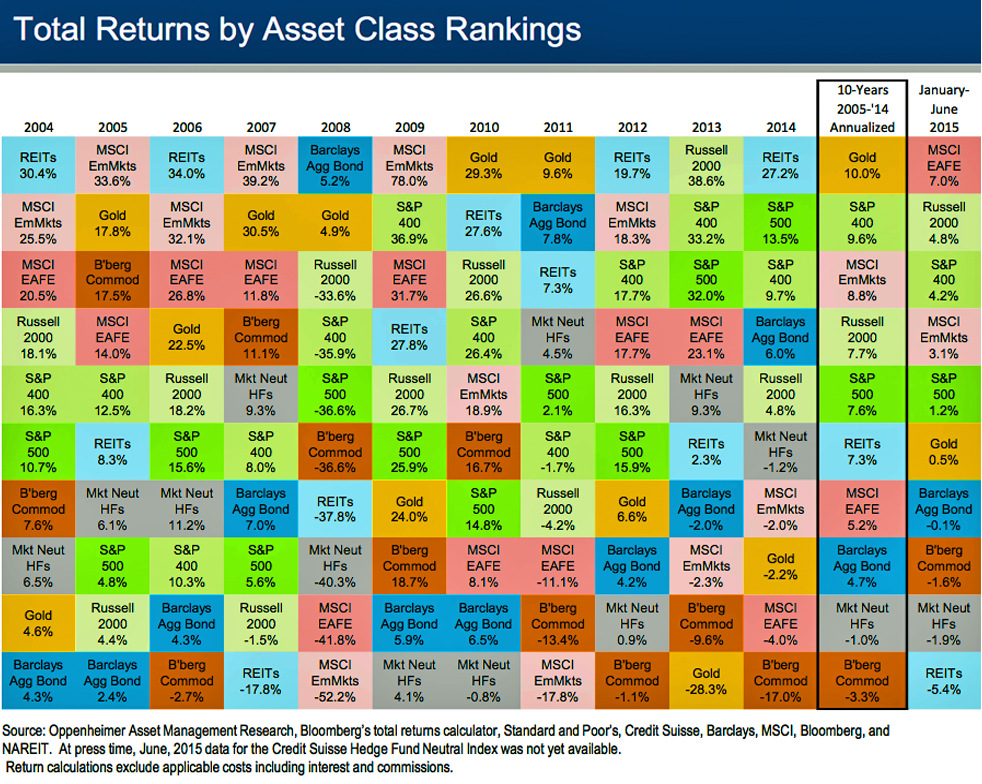

The NAREIT Index shows that the asset class has beaten out stocks bonds diversified portfolios commodities and cash. Moreover the asset classes list is organized according to each assets nature response to market volatility returns and target. On the other hand real estate investment trusts REITs have been the worst-performing investments.

Real estate has the highest risk and the highest potential return. This levering up creates a riskreturn continuum by which we can assess risk-adjusted net-of-fee performance of non-core funds through the volatility of gross returns. The Preferred section is comprised of the 10 highest-ranked Asset Classes.

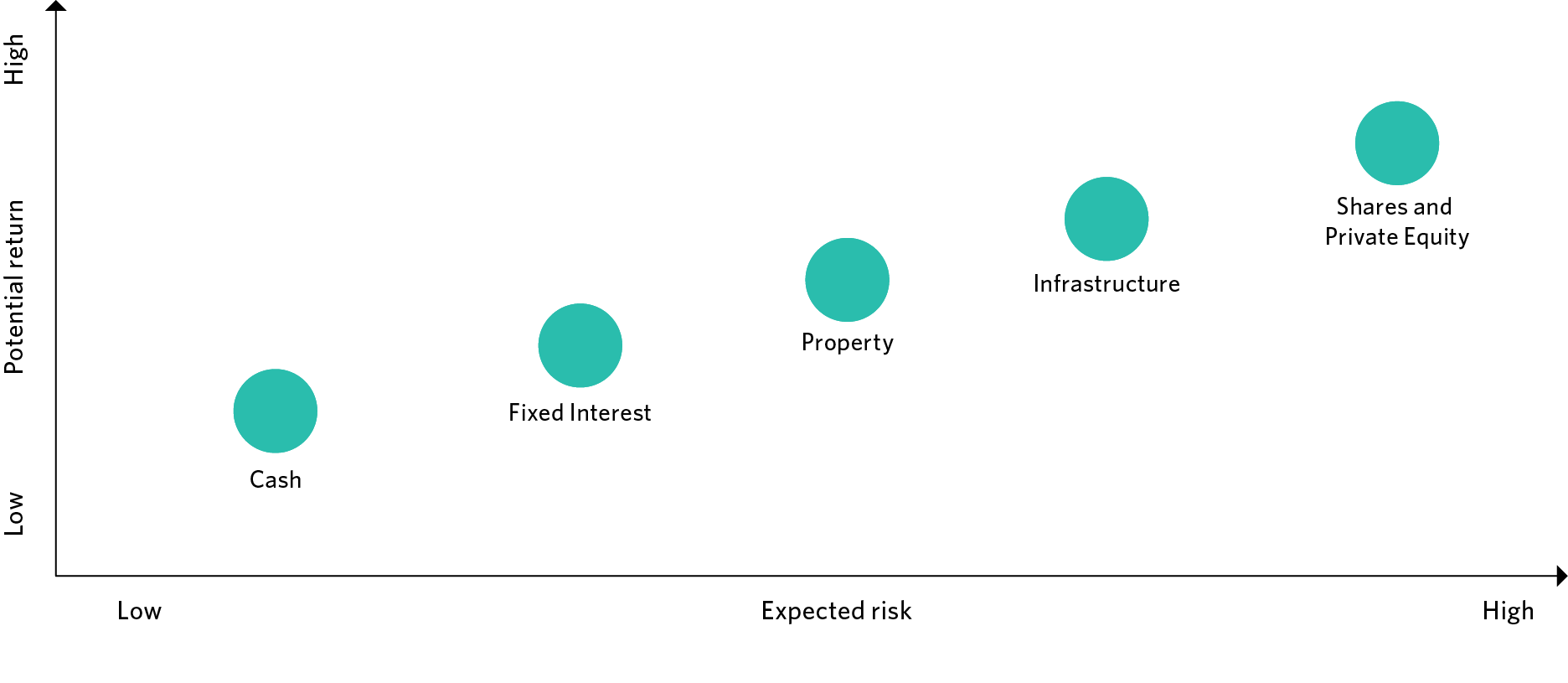

As you can see in the chart above historically the amount return or earnings has increased as the risk associated with the investment class has increased. For investors to take on higher risks they would need to be adequately compensated for the additional risks that they bear. Risks and rewards of ownership Interest rates Rents Capital gain or loss on sale of direct holdings The role of.

Im mainly looking at. Meanwhile a majority of those who retire in their 50s and 60s expect to live much longer than 20 years and thus most consider inflation risks as much of a threat as stock market risk. Each asset class is unique regarding the related risk taxation ownership exchangeability revenue rules and market instability.

Global commodities saw the lowest return over the last 10 years. Ranking the real estate asset classes in terms of risk Dear all. Evaluate credit risk juggle different pass-through reimbursement structures and general asset marketingpresentation that I would argue are more sophisticated than other asset classes.

Oct 21 2016 235 PM EDT. Risk and return drivers for real estate include. Ranking the real estate asset classes in terms of risk.

Some risks are shared by every investment in an asset class. Asset class is a group of assets with similar characteristics particularly in terms of risk return liquidity and regulations. 13 Last Rank of Time In Top Half of Ranks Ranks 1-6 Emerging Market Stocks.

Federal government Treasury coupons. Equities stocks and fixed income bonds are traditional asset class examples. Real estate experts and investors share different perceptions when it comes to ranking property and area classes.

Ad Invest in income-producing offices train stations warehouses more. Real estate as represented by the National. Annuity perpetuity coupon rate covariance current yield par value yield to maturity.

Commercial real estate offers two ways to diversify your investment portfolio. Asset Class Risk Spectrum. High risk with high return to low risk with low return.

See the bottom of the graphic for the specific indexes used. Different states and cities can also. The Ranking Table shows a Preferred section a Neutral section and an Avoid section.

A drop in the stock market does not necessarily correlate to a fall in real estate. The class of the asset is far more dynamic than just the age of a property. Its much like the color ranking on a ski hill.

The sacred cow of real estate asset classes has consistently been core assets such as retail office and Class A multifamily. One example would be Real Estate Investment Trusts REITs. The first asset class is real estate.

LEX is providing access for all get started with commercial real estate investment today. This charts provides some references. Homes built in the last 10-20 years.

Fixed Income Bond Terms Definitions for the most common bond and fixed income terms. As an asset class real estate investments have traditionally been ranked somewhere in between fixed income and equities as depicted schematically in the diagram below. But I find this definition to be too narrow.

In real estate investing theres always demand for apartments in good and bad economies so multifamily real estate is considered low-risk and therefore often yields lower returns. The Preferred-ranked Asset Classes are superior and all new funds should be put into Asset Classes ranked in this section. Some examples of major asset classes include equities bonds money markets and real estate.

Relationship Between Risk and Return. I personally transitioned from office to multifamily and find multifamily much easier to. Standard Deviation of Ranks.

The Neutral section is comprised of those Asset Classes which rank higher than the. The asset classes types include fixed income cash cash equivalents equity and real estate. Volatility is the change in value up or down of an investment.

-Multifamily -Retail -Office -Student living -Light industrialsLogistics -Hotels -Co-working spaces I know that there are several factors. Needless to say economic shutdowns due to COVID-19 have had a devastating effect on commercial real estate. There are significant differences between stocks and bonds different asset classes such as risk how they are traded how they pay.

Homes built in the last 20-30 years. Commercial real estate is a longer-term investment. In addition the higher the risk the more volatility you may experience.

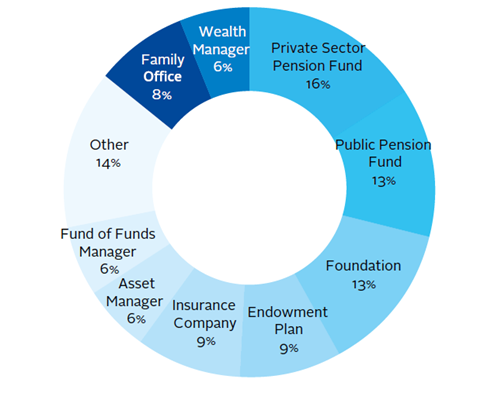

Alternative Assets How Much Will They Grow By 2025

Reits Is The Most Consistent Asset Class Providing The Best Return Over The Past 15 Years Seeking Alpha

New Morningstar Analysis Shows The Optimal Allocation To Reits Nareit

Know Your Real Estate Risk Reward Spectrum Before Investing

Reits Is The Most Consistent Asset Class Providing The Best Return Over The Past 15 Years Seeking Alpha

Part Ii On Asset Classes Size Of Markets And Trading Volumes By Les Nemethy And Sergey Glekov Europhoenix

All About Asset Classes And Investment Diversification The Motley Fool

Reits Is The Most Consistent Asset Class Providing The Best Return Over The Past 15 Years Seeking Alpha

Commercial Real Estate Trends Toptal

Know Your Real Estate Risk Reward Spectrum Before Investing

Year In Review 2016 Asset Class Performance Seeking Alpha

Know Your Real Estate Risk Reward Spectrum Before Investing

Rethinking Asset Allocation Kkr

Chart The Historical Returns By Asset Class Over The Last Decade

How Housing Became The World S Biggest Asset Class The Economist

Asset Classes Explained Understanding Investments Unisuper